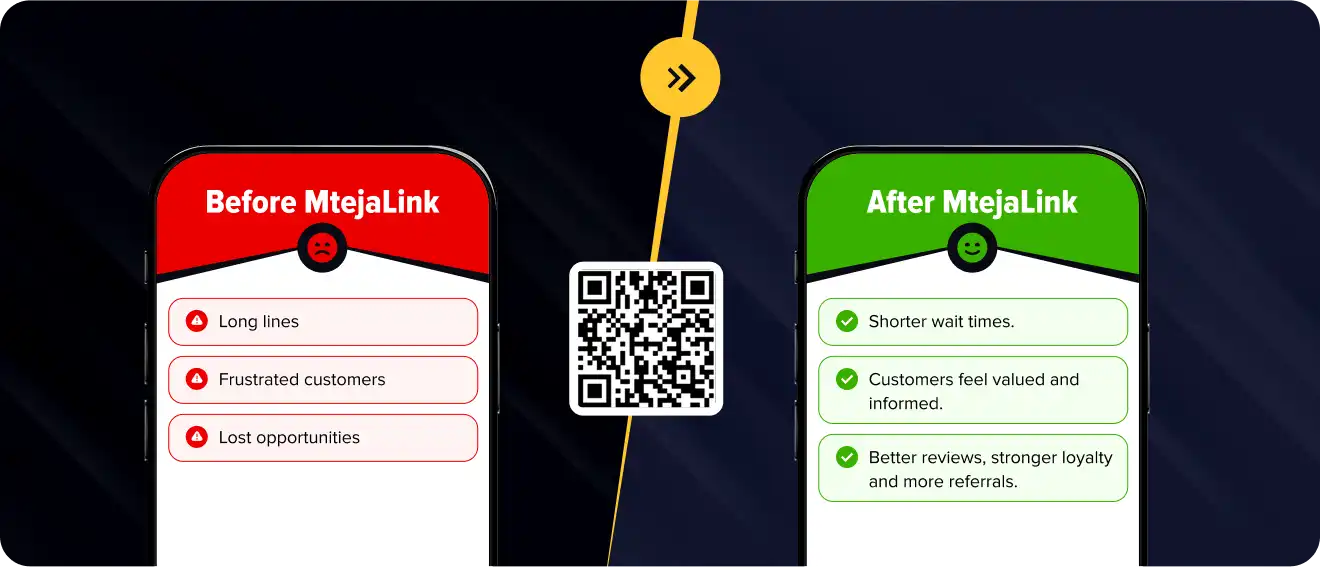

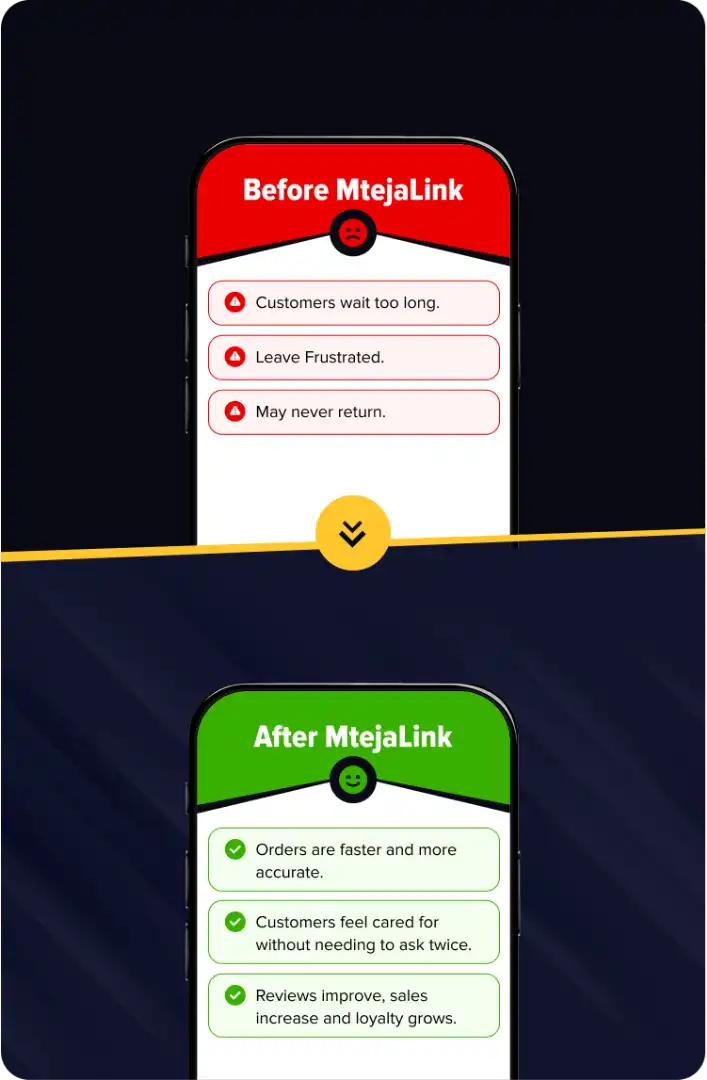

Why long queues and delays cost you more than time

When customers wait too long:

They leave frustrated and tell friends or post online.

They lose trust in your ability to handle their money or requests.

Some never come back, taking their accounts - and deposits - with them.

By the time you find out they were unhappy, it’s already too late to win them back.

Most members don't complain - they simply stop trusting or quietly switch branches.

Most tellers never get recognised - morale declines and service drops.

MtejaLink helps you catch both - before they turn into churn or regulator complaints.

Why This Matters for Financial Institutions

Members don’t fill surveys - they exit emotionally long before they exit physically.

Your best staff carry your brand - but without visibility, great service goes unnoticed and unmeasured.

MtejaLink captures live branch signals. Mteja360 routes them into action - with optional HQ visibility across all branches.

MtejaLink is built on proven technology already used by over 100 corporate clients to manage service requests and customer feedback.

It works in branches, ATMs and even for remote banking services.

You get real-time alerts, service tracking and instant feedback so you can fix issues before they damage your reputation.

How It Works

How It Works

Place QR codes in branch lobbies, teller counters and ATM areas.

1

Customers scan or use the MtejaLink app to log service requests, ask questions, or leave feedback.

2

Your team gets notified instantly and can respond quickly - no need for long lines to get basic help.

3

One Scan. Every Customer Need.

Solved.

Key Features for Banks & SACCOs

Moments (Campaigns That Click)

Promote new products, loan offers, or financial literacy campaigns directly to customers at the branch – in a format they’ll actually engage with.

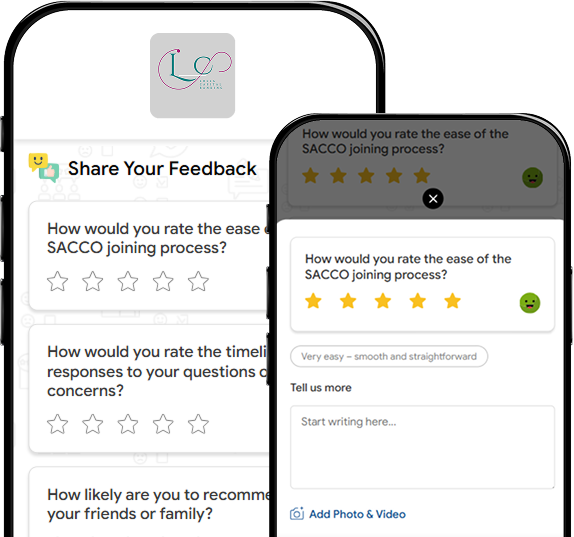

Shape the Experience (Experience Shaper™)

Let members, walk-in customers and even frontline staff share suggestions, service frustrations or appreciation instantly - at teller desks, loan counters, ATM kiosks or member desks - through a simple scan.

Reputation Pulse™ - Staff Recognition & Alert Intelligence

Customers can mention staff by name, giving your best tellers and advisors visible recognition.

Repeated issues against a counter or department trigger private coaching alerts inside Mteja360 - improving service reputation discreetly.

Rate Your Experience (Quick CSAT / Branch Sentiment Score)

Quick rating check-ins tied to specific touchpoints - teller desk, loan window, member support counter or ATM hall - giving you branch-level sentiment dashboards without long forms.

Internal Routing for Branch Staff & HQ Oversight - Powered by Mteja360 (Optional)

Single-branch SACCOs can simply receive alerts by manager login or intervention team,

while larger financial institutions can enable Mteja360 HQ dashboards to compare branch performance, recognition levels and service alerts across locations.

Works for

-

Village banking agents & microbranch SACCOs - simple scan → manager sees feedback

-

Urban banks & multi-branch SACCOs - scan → routed to relevant department → HQ sees branch reputation signals in dashboard

-

Digital banking lounges / ATM halls / loan offices - members scan on the spot

-

Staff scanning proactively to log pain points or service improvement notes internally via same link

QR at Counters, ATMs & Branch Entrances

Customers scan to request help, give feedback, or access FAQs instantly – no more waiting in long queues for simple issues.

Feedback That Works

Real-time, location-aware feedback flags service problems before they become public complaints.

AI Banking Assistant (24/7 Support)

Answers FAQs like loan eligibility, account opening requirements, or balance inquiries – anytime, without staff involvement.

Seamless Payments (Mpesa, Bank & eCitizen)

Enable payments for services, loan repayments, or account fees directly in-app – no slips, no wrong entries, fully auditable.

Ticket Tracking

Every customer request – from queue feedback to service escalation – is tracked from start to finish for accountability.

Why This Matters for Financial Institutions

Members don’t fill surveys - they exit emotionally long before they exit physically.

Your best staff carry your brand - but without visibility, great service goes unnoticed and unmeasured.

MtejaLink captures live branch signals. Mteja360 routes them into action - with optional HQ visibility across all branches.

Protect your reputation and win customer loyalty with real-time service, smarter campaigns and instant payments - all in one simple tool.

Outcome

From Slow Service to

Customer Confidence

From Slow Service to

Customer Confidence

What Banking Leaders are Saying

We began seeing live branch sentiment and staff mentions before complaints were ever filed - and our branch staff started taking pride in being named by members.

- Head of Member Experience, Cooperative Financial Network

Start a Free Trial - See Live Member Voice

& Branch Service Recognition Before

the Next Audit Cycle.

& Branch Service Recognition Before

the Next Audit Cycle.

Simple for single branches. Scalable for national networks.